The Benefits of Medicare: Making Certain Affordable Health Care for All

In a world where accessibility to cost effective medical care continues to be a pushing problem, Medicare arises as a beacon of hope for millions of individuals. From its extensive insurance coverage to its broad network of service providers, Medicare stands as an essential lifeline for those seeking budget friendly medical care.

Comprehensive Coverage

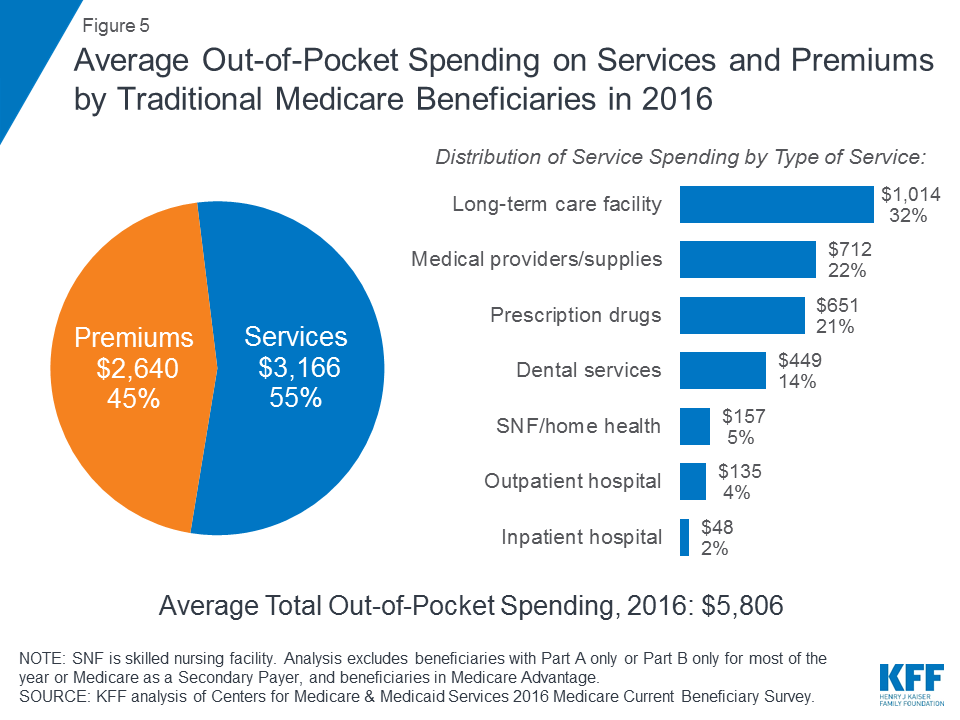

Comprehensive protection under Medicare guarantees and gives extensive advantages that people have accessibility to a wide variety of essential healthcare solutions. Medicare, a federal health insurance coverage program mostly for individuals aged 65 and older, provides coverage for healthcare facility keeps, physician visits, prescription medications, preventive services, and extra. This thorough coverage is made to provide financial defense and tranquility of mind to Medicare recipients, enabling them to get the care they need without encountering exorbitant out-of-pocket expenses.

One of the crucial advantages of comprehensive coverage under Medicare is the accessibility it provides to a broad array of healthcare solutions. Medicare beneficiaries have the freedom to pick their doctor, consisting of medical professionals, experts, health centers, and various other health care centers, providing the adaptability to obtain care from trusted experts. This ensures that individuals can receive the required clinical therapy and services, including preventative care, diagnostic examinations, surgeries, and recurring care for persistent conditions.

Moreover, Medicare's thorough protection includes prescription drug advantages. With Medicare, beneficiaries have accessibility to a formulary of covered prescription medications, which helps to minimize the financial burden of acquiring medications.

Cost-Sharing Options

Furthermore, Medicare provides the alternative of buying supplemental insurance policy, understood as Medigap, to aid cover the prices that original Medicare does not pay for. One more cost-sharing option is the Medicare Part D prescription medicine coverage, which aids beneficiaries afford their needed drugs. Generally, these cost-sharing choices play an essential duty in ensuring that Medicare beneficiaries can access the medical care they need without dealing with frustrating financial burdens.

Wide Network of Providers

An essential advantage of Medicare is its considerable network of doctor. Medicare is a federal health and wellness insurance policy program that offers protection to individuals matured 65 and older, as well as particular younger people with impairments. With over 1.4 million medical care companies taking part in Medicare, recipients have accessibility to a variety of medical professionals, healthcare facilities, and centers across the country.

Having a broad network of companies is crucial in ensuring that Medicare recipients have accessibility to the healthcare services they need. With Medicare, individuals have the liberty to pick their doctor, giving them the versatility to look for treatment from experts and doctors that ideal meet their needs.

Medicare's network of companies includes health care medical professionals, professionals, health centers, taking care of homes, and home health firms. This wide variety of providers ensures that recipients can get detailed and collaborated treatment, from check my site regular check-ups to specialized treatments.

Furthermore, Medicare's network additionally consists of carriers that approve assignment, indicating they consent to accept Medicare's authorized quantity as repayment in full for covered solutions. This helps to keep expenses down for recipients and makes certain that they are not entrusted excessive out-of-pocket costs.

Prescription Drug Coverage

Prescription medicine coverage is a vital part of health care for numerous individuals, making certain access to needed drugs and promoting total well-being. Medicare, the government medical insurance program for individuals matured 65 and older, uses prescription medication coverage with the Medicare Component D program. This protection assists recipients pay for the expense of prescription medications, which can often be expensive.

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)

In Addition, Medicare Component D plans typically negotiate affordable costs with pharmaceutical manufacturers. These bargained prices assist reduced the out-of-pocket costs for beneficiaries, making drugs extra affordable and easily accessible. The program likewise includes a tragic protection provision, which helps safeguard recipients from high medication costs by restricting their yearly out-of-pocket costs.

Preventive Providers

Advertising general wellness, Medicare Part D likewise uses protection for a series of preventative solutions that assist people preserve their wellness and spot prospective issues beforehand. Medicare identifies the importance of preventive treatment in reducing medical care expenses and boosting total health and wellness outcomes.

Under Medicare Component D, recipients have access to a this content range of preventive solutions, such as screenings, inoculations, and therapy. These solutions are made to identify or prevent health problems at an onset when treatment is more effective and much less pricey. Examples of precautionary services covered under Medicare Part D include mammograms, colonoscopies, flu shots, and smoking cigarettes cessation counseling.

In addition, precautionary solutions can also help people make informed choices about their health. With counseling and education and learning, recipients can find out about healthy way of living selections, disease avoidance approaches, and the relevance of routine exams. This equips individuals to take control of their wellness and choose that favorably influence their wellness.

Conclusion

In conclusion, Medicare provides extensive coverage, cost-sharing alternatives, a wide network of carriers, prescription drug insurance coverage, and preventative services. These benefits ensure that budget friendly medical care is obtainable to all people. The program plays a crucial role in advertising the wellness and lifestyle for the senior, handicapped, and low-income populaces. By removing individual pronouns, a much more academic and unbiased style of composing is achieved.

Comprehensive insurance coverage under Medicare ensures and supplies substantial advantages that individuals have accessibility to a wide array of needed medical care services - Medicare advantage agent in massapequa.One of the vital benefits of thorough insurance coverage under Medicare is the gain access to it offers united health insurance to a wide array of health care services. Additionally, Medicare supplies the alternative of acquiring additional insurance coverage, understood as Medigap, to aid cover the prices that initial Medicare does not pay for. Medicare, the government health and wellness insurance policy program for people aged 65 and older, provides prescription medication insurance coverage via the Medicare Part D program.In verdict, Medicare provides extensive insurance coverage, cost-sharing alternatives, a broad network of carriers, prescription medication protection, and precautionary services

:max_bytes(150000):strip_icc()/insurance-policies-everyone-should-have.asp-final-cf42cc8f61ae46a7acffc9b519457815.png)